Bajaj Finserv wants to stay ahead in India’s financial market and wants to create a wave in the stock market, in mutual fund innovation and in ambitious customer expression expansion.

Within this blog, we will take pivotal updates of some of its firms(Bajaj Finserv) and will unpack them and take highlights of 2 July 2025. We will disclose its strategy in the way of investor take waves and we will talk about what is going to happen next.

Market Snapshot – Stock Performance

● Bajaj Finserv share today slid ~ 1-1.7% in the trading day in the range of ₹2,020 to ₹2,034 this morning. This stock showed a lot of volatility and broader sentiments and it appeared to be a very steady stock.

● Despite some analysis downgrading it, 14 out of 21 people recommended buying it. Its return target is around ₹2034 –suggesting a recovery Outlook.

This present dip can become a good buying opportunity for long-term investors, who want to ride on growth initiatives and are looking at earning prospective.

Ambitious Customer Growth Plan

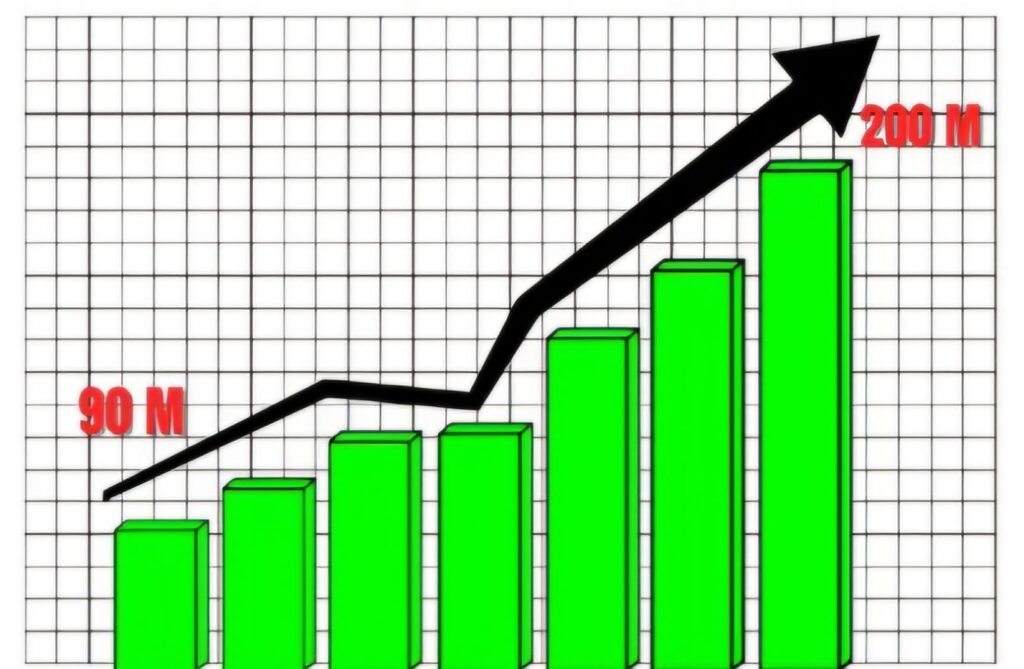

● Chairman Sanjiv Bajaj announced a bold new decision scale: the customer base will be increased to 250 million in the next 5 years and his goal is to reach 200 million by 2029.

● With ~92 million customers, he is currently leading in insurance and investment and his firm has added ~ 10 Millions customers in the last 2 years . This indicates strong good growth of his company.

Why It Matters:

Increased cross-selling possibilities, deeper product penetration, and steady revenue traction are all benefits of growing the client base.

Innovation Spotlight – Chhota SIP Debut

- The asset management arm is testing micro SIP ( systematic investment plan ) product that can be started at a minimum amount like Rs 100.

- This idea will encourage low income and new investors to join the mutual fund ecosystem.

- Its implementation is under review, and its focusing on feasibility with tech partners and payment gateways.

- Expected launch: In ~6 months (after viability tests).

Small Cap Fund Launch & Tech-Focused AMC Expansion

- Bajaj Finserv has recently launched a Small Cap Fund which aims to ensure selection of quality small cap stocks in the fund.

- The companies are also doubling down on digital interfaces like chatbots and mobile-first investing to attract new-age investors.

- CEO Ganesh Mohan mentioned, “Product innovation, backed by tech, is our route to differentiation.”

What to Watch Next

| Factor | Detail |

|---|---|

| 📅 Q1 Results | Coming next week (FY26 Q1 Earnings) |

| 🚀 Trigger | Micro-SIP product launch could drive new AUM growth |

| 📈 Investor Outlook | Long-term bullish, short-term watchlist near ₹2,020–2,034 zone |

FAQs – Bajaj Finserv July 2 Events

Q1. Who is the new target client for Bajaj Finserv?

Instead of aiming for 2029, they now want to attain 250 million users in just 4 years.

Q2. Describe Chhota SIP.

Small investors can start investing in mutual funds with this micro SIP plan, which starts at ₹100.

Q3. What caused today’s decline in Bajaj Finserv stock?

The stock saw a minor decline as a result of general market volatility, even in spite of encouraging announcements.

Q4. Which new mutual fund was introduced by Bajaj Finserv?

With an emphasis on long-term value equities, they started a Small Cap Fund.

Q5. When will the Q1 results be available?

Anticipated early July 2025, next week

3 thoughts on “Bajaj Finserv’s Bold Moves : ₹100 SIP Plans, 250M Target & Stock Buzz – July 2 Highlights”