Hello friends, today we are going to study a very important finance related term What is EBITDA in Share Market and EBITDA full form in Finance. Today you will learn a lot in this blog. If you are going to read the entire blog, then let’s get started.

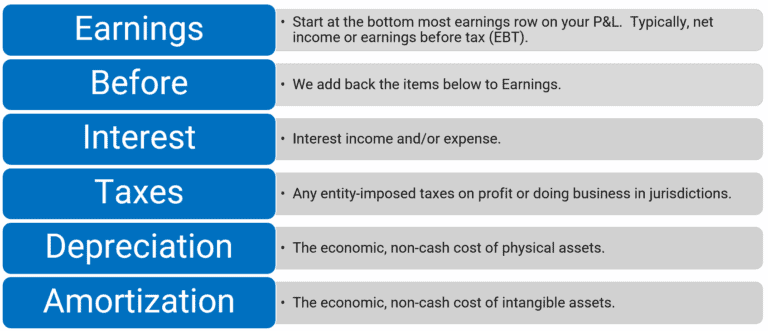

EBITDA Full Form:

- EBITDA : Earnings Before Interest, Taxes, Depreciation, and Amortization

When we hear the term EBITDA, financial terms come to our mind. EBITDA is a very big part of a company. EBITDA is the financial heart of a company. The values of a company whose EBITDA is very good, the roots of the company and the capabilities of the core team are clearly visible in it. Since there is an expectation of high growth in the market, its valuation is also very good.

Important Tool to Compare Companies

The term EBITDA is very important in a financial ecosystem. This term understands the actual profit of the company. It does not include interest on loans, government taxes, machine cost (depreciation), and intangible assets (amortization). This term makes it easy for investors to understand how much profit the company is generating from its core business. This term can be very useful in helping investors understand the financial structure of a company, like interest, taxation, amortization.

Analyze Real Operating Performance with EBITDA

EBITDA helps you to understand the core business of a specific company. This term shows the real operating performance of the company and comes out with operational costs like the company’s interest, taxes, depreciation and amortization.

This term shows how strong the company’s core profit and process system are and also shows how profitable the company is or how profitable it is running. It shows pure performance – without disruption.

What is EBITDA Meaning in Share Market?

The term EBITDA is very easy for investors and institutions to study a company or helps a lot. This term helps in understanding in easy language whether the core business of the company is profitable or not. There is no need to understand or learn much accounting to understand this term. It is easy for a common man to understand or will understand it. Therefore, even a common man can analyze a company by looking at the term EBITDA and can invest in share market.

EV/EBITDA Ratio Tells You If a Stock is Overvalued

EV/EBITDA is a term that tells us or shows us what the overall value of a company is in comparison to its actual earnings.

- High EV/EBITDA : If the company’s Enterprise Value (EV) / EBITDA value is high, then the company is expensive but also overvalued. The market or investors have very high expectations of growth from this company.

- Low EV/EBITDA : If the company’s ratio is low, then the company is cheap in terms of earnings. The company is also undervalued and in such a company, investors have a good opportunity for investment and future growth.

Take a Reference of a Youtube Video Here :-

EBITDA ≠ Net Profit – Know the Key Difference

- EBITDA is the term that shows the earnings of a company and which is formed by various operations of the company and the income or earnings of that balance sheet. EBITDA is calculated by calculating the term before deducting interest, taxes, depreciation and amortization.

- Net profit on the other hand, this term shows the final profit of the company after deducting all expenses, including interest, taxes, depreciation, amortization and other non-operating costs.

Higher EBITDA = Strong & Profitable Business Model

How is the growth rate of a company measured? It is measured by the term EBITDA. A company whose growth rate is very good has a very good strength in its core business and its impact is also visible on the balance sheet. It is seen that the core operations of that company are working very well. If the EBITDA is high, it means that investors believe that the core team of this company is very good. This also leads to high valuation growth and the stock market has high expectations from that company.

EBITDA is Used Globally by Analysts & Institutions

EBITDA is a universally accepted term. Large institutions and businesses use this term to compare or collect data. Investors can find the data and financial structure of any company in any corner of the world and study it. Because EBITDA is a very simple and understandable metric, it can easily evaluate the balance sheet, financial health, and business strength of a company.

Smart Investors Always Check EBITDA First

As we have seen above, this term is universally accepted and many universities and institutions have done research on this term, so it is very reputable. Therefore, before making any investment, investors and institutions analyze it and it becomes simple to understand the core profitability of that company by understanding the balance sheet of that company. So it is an important and useful term in the overall finance sector and I think I have been able to explain this metric to you in simple language. Thank you!

FAQs on EBITDA

1. What is the full form of EBITDA?

Earnings before interest, taxes, depreciation, and amortization is referred to as EBITDA. It is a financial indicator that assesses how well a business operates.

2. What does EBITDA mean in the share market?

EBITDA is used to assess a company’s basic profitability in the share market. By removing the impact of finance and accounting choices, it gives investors insight into how much a firm makes from its real business activities.

3. Why is EBITDA important for investors?

EBITDA eliminates factors like taxes and interest costs and provides a straightforward picture of a company’s capacity to generate cash, which is helpful when comparing businesses across industries.

4. What is the difference between EBITDA and Net Profit?

- Operating performance before interest, taxes, and non-cash expenses is displayed by EBITDA.

- The total profit after all costs, such as interest and taxes, is known as the net profit.

5. Can EBITDA be negative?

Indeed. An organization may be in bad financial health if its operational expenses exceed its income, as shown by a negative EBITDA.

1 thought on “What is EBITDA Meaning in Share Market? | EBITDA Full Form in Finance Explained 10 Points”